Compliance with 5 FTSE Board Governance Targets in 2025

Companies listed on the Main Market of the London Stock Exchange should consider a range of targets for the composition of their boards, and report against them on a ‘comply or explain’ basis.

The Numerable board intelligence platform continuously tracks metrics and compliance for 5 key targets, for all 537 companies in the FTSE 100, 250 and SmallCap indexes, which together make up the FTSE All-Share index.

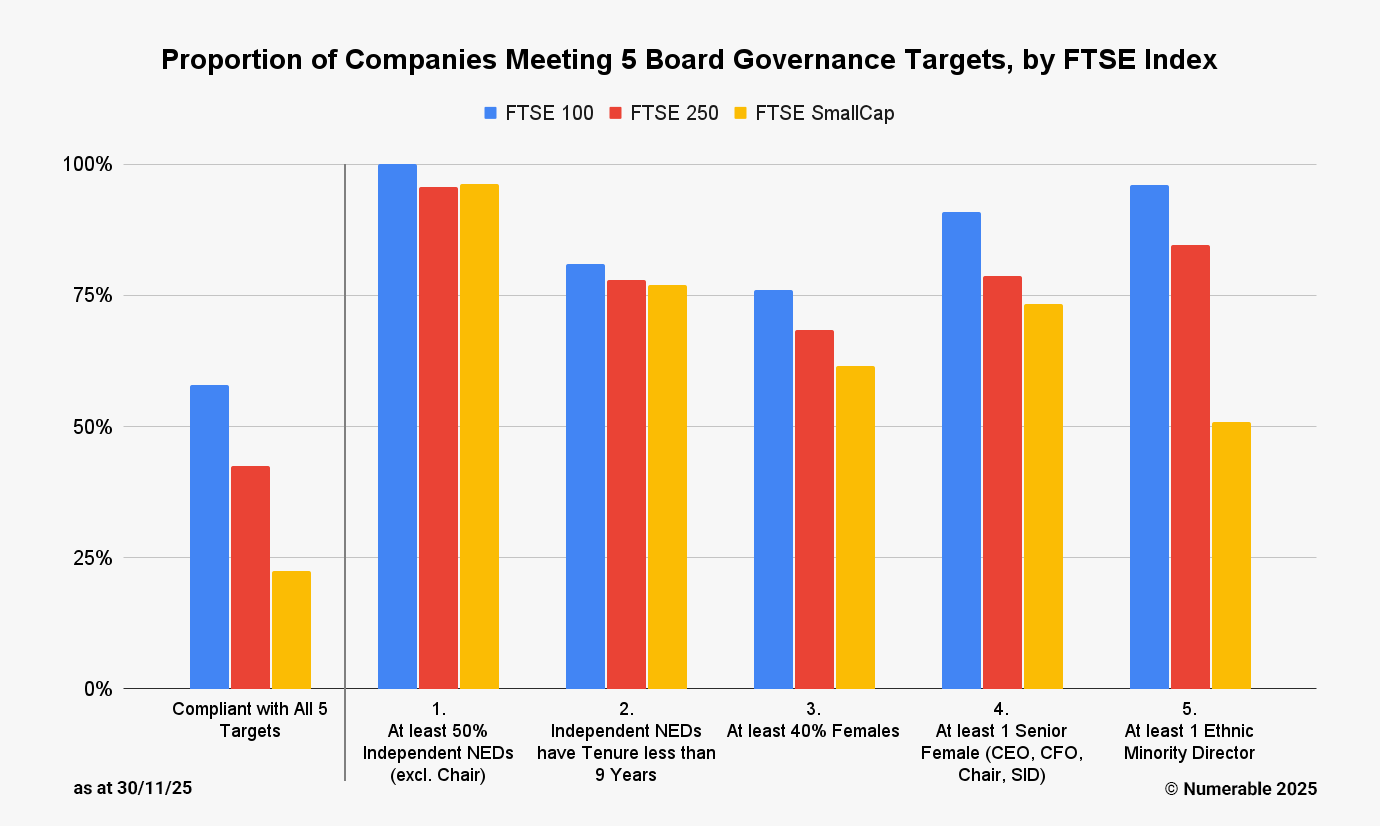

At the end of November 2025 only 38% of those companies met all 5 targets.

Full compliance is highest in the FTSE 100 (58%), lower in the FTSE 250 (42%) and lower again in SmallCap (23%).

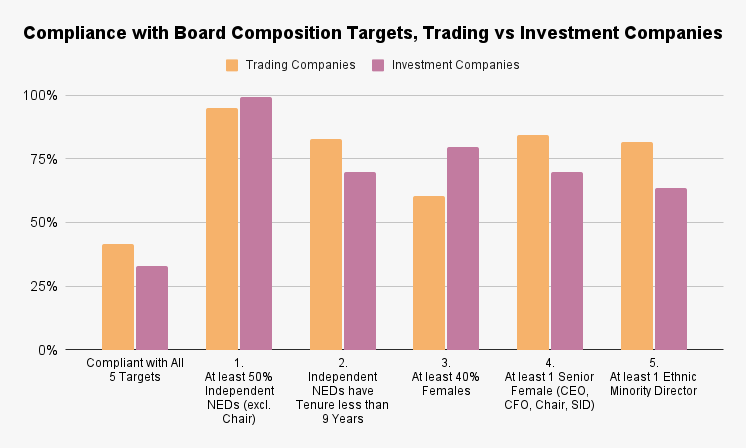

A higher proportion (42%) of trading companies are fully compliant than is the case for investment companies (33%).

The Targets

The first two targets, relating to director independence, are set in the UK Corporate Governance Code (and also in the AIC Corporate Governance Code that investment companies can choose to follow).

The three other targets, for gender and ethnic diversity, are in the FCA Listing Rules.

These three targets emerged from recommendations by the FTSE Women Leaders Review and the Parker Review.

The targets matter because they indicate best practice for the composition of boards.

A diverse board with a majority of independent directors has members with a broad range of perspectives, skills, and experiences. This reduces ‘groupthink’ and helps boards give objective strategic guidance, make effective decisions, and represent the views of a range of stakeholders..

Investment institutions and their proxy advisers review compliance with governance targets and this can affect investment decisions and voting behaviour at AGMs.

The targets influence the evolution of boards. A non-compliant company typically develops a succession plan that aims to achieve compliance. This can be an opportunity for the executive search firms that advise boards and their Nomination Committees.

Variations Between Indexes

Compliance with the two independence targets is similar across the three indexes.

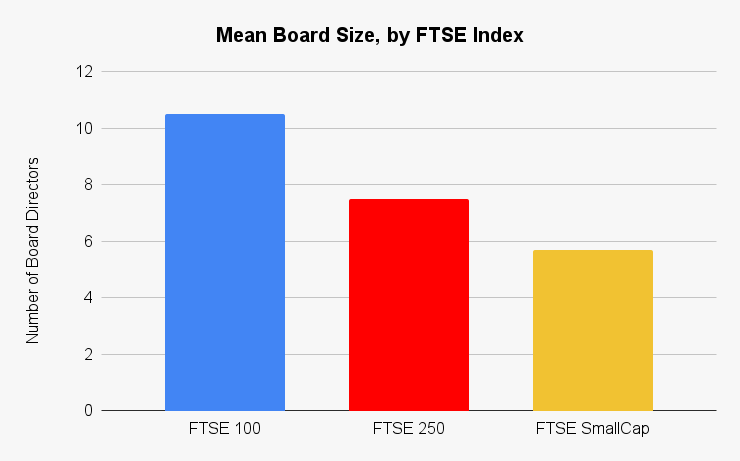

However there is a striking drop off in compliance with diversity targets from the FTSE 100 to 250, and from the 250 to SmallCap. A major factor causing this appears to be board size.

FTSE 100 companies have larger boards (mean 10.5) than FTSE 250 companies (7.5) and SmallCap ones (5.7). This leads to more ‘space’ to include a broader range of directors.

The average director tenure is 7-8 years in all three indexes. The larger FTSE 100 boards therefore appoint new directors more often than 250 and SmallCap ones, and can evolve more quickly to meet targets.

Another factor affecting compliance could be that investors focus more on governance of companies in the FTSE 100 and 250, motivating the boards to become compliant.

Variations Between Trading and Investment Companies

There are 196 (36%) investment companies, such as trusts, among the 537 constituents of the three main FTSE indexes that make up the FTSE AllShare index.

While 42% of trading companies comply with all 5 targets, only 33% of investment companies do.

Investment companies face particular challenges in meeting the Senior Female and Ethnic Minority diversity targets because:

- they usually have smaller boards (mean 5.1 directors) – so it is harder to meet diversity targets, as discussed above, and

- only 6 (3%) of them have any executive directors (e.g. CEO and CFO) – so they can only meet the Senior Female target if the Chair or Senior Independent Director (SID) is a woman.

Trading companies, on the other hand, have a higher mean board size of 8.7, and a large majority (94%) of them have a CEO, and usually a CFO, on the board.

The lack of executives on investment company boards does, however, result in a higher proportion of investment company boards meeting the 40% Females target than is the case for trading companies. This is because across all FTSE boards just 16% of executive directors are women, while 50% of non-executives are women.

Conclusions

There are significant variations in the levels of compliance with the 5 board composition targets when we compare the 3 main FTSE indexes, and also between trading and investment companies.

The main factor affecting these differences appears to be board size.

The characteristics of investment company boards present particular challenges for them to meet some diversity targets.

____________________________________________________

Numerable is an innovative board intelligence platform with an accurate, up-to-date database of LSE listed public companies, directors, appointments, and associated governance and diversity metrics. It continuously collects and harmonises published information from company registries, annual reports, news releases and websites. It has a range of powerful, interactive tools to browse, search, filter, sort and analyse. It is a cost-effective solution available on subscription.

Please contact us for a demonstration or to arrange a free trial.