The State of FTSE Board Diversity in March 2024

It is broadly recognised, and confirmed by research, that a diverse board of directors can lead to more effective decision making, as well as representing a broader range of stakeholders.

A year ago the FCA updated or introduced three board diversity rules.

We have analysed the data collected by Numerable to find out how many FTSE companies now comply.

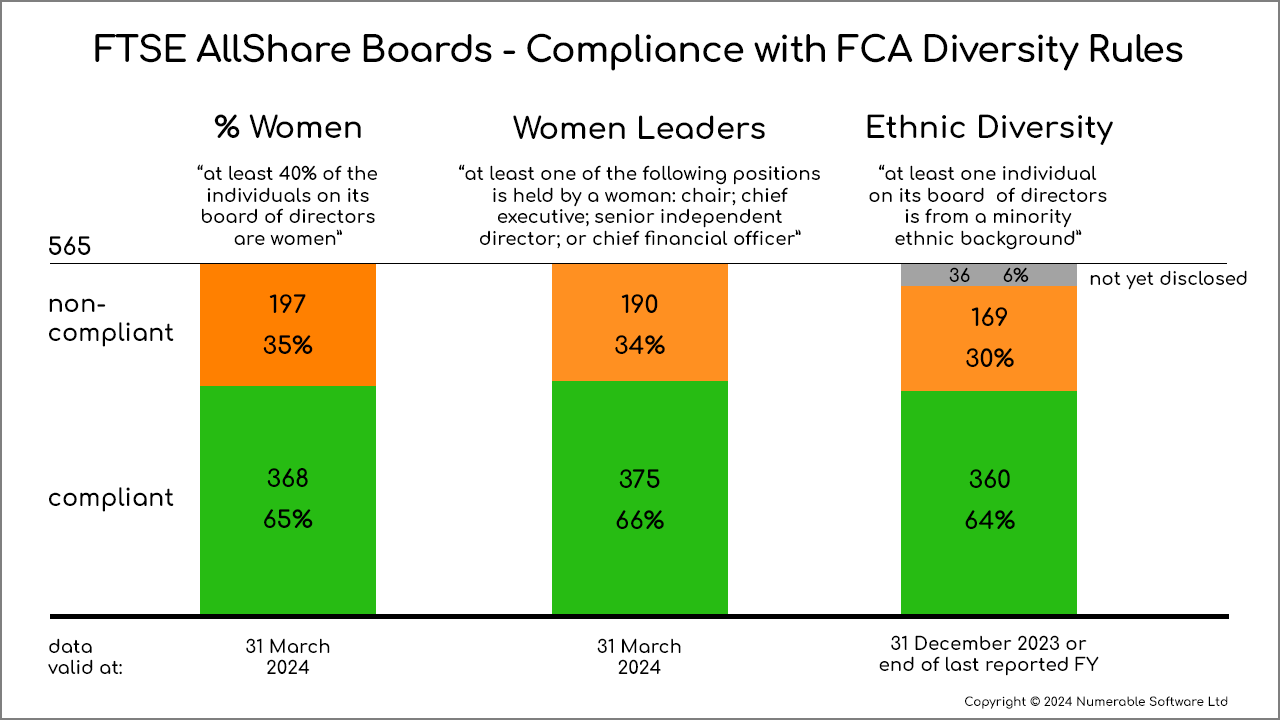

At the end of March 2024 around a third of the 565 FTSE AllShare companies still did not comply with each rule.

The Rules

The diversity targets are defined in the Listing Rules issued by the FCA (Financial Conduct Authority), available online at https://www.handbook.fca.org.uk/handbook/LR.pdf#page=172.

They emerged from recommendations by the FTSE Women Leaders Review (previously the Hampton Alexander Report) and the Parker Review.

The FCA rules are not compulsory; they are on a “comply or explain” basis. Companies should disclose if they have met each rule’s target. If not, they they should explain why.

The diversity rules apply to companies with a premium listing on the Main Market of the London Stock Exchange, including all those in the FTSE AllShare Index.

Key stakeholders, such as investment institutions and their proxy advisers, review compliance with FCA rules such as these. This can affect investment decisions or voting at AGMs.

Each company should report whether:

- Percent women: “at least 40% of the individuals on its board of directors are women”

- Women leaders: “at least one of the following senior positions on its board of directors is held by a woman: the chair; the chief executive; the senior independent director; or the chief financial officer”

- Ethnic diversity: “at least one individual on its board of directors is from a minority ethnic background”

Levels of Compliance

The proportion of FTSE AllShare companies that comply with each of the 3 rules is surprisingly similar for each of the three rules, at around ⅔.

We last analysed these proportions in November 2023. Over 4 months, the levels of compliance have increased for all 3 rules.

The compliance levels on both dates are:

| Target | November 2023 | March 2024 | Increase | |

| Percent Women | at least 40% of directors to be women | 62.1% | 65.1% | 3.0% |

| Women Leaders | at least one of CEO, CFO, Chair or SID to be a woman | 64.2% | 66.4% | 2.2% |

| Ethnic Diversity | at least one director to be from an ethnic minority | 58.6%

(13.6% had not disclosed) |

63.7%

(6.4% had not disclosed) |

5.1% |

The biggest increase is in the ethnic diversity compliance. That appears to be mainly because around 40 companies that had not disclosed their ethnic diversity compliance in November 2023 have now done so.

It is not, generally, the same companies that comply with each rule:

- 32 (5.7%) companies do not comply with any of the 3 rules

- 139 (24.6%) comply with 1 rule

- 218 (38.6%) comply with 2 rules

- 176 (31.2%) comply with all 3 rules – so less than a third of the companies are fully compliant.

Insights

- At 31 March 2024 there were 5 FTSE AllShare companies that had all male boards. All 5 were investment companies, mostly with small boards.

- There were, on 31 March 2024, no FTSE companies with all female boards.

- Compliance levels are generally higher in FTSE 100 companies than in FTSE 250 companies, which in turn are higher than those in SmallCap companies. This correlates to the average board sizes, which are larger in FTSE 100 (average 10.6 directors) than FTSE 250 (7.7 directors) and SmallCap (6.0 directors). Larger boards tend to have more frequent changes.

- Investment companies, as compared to trading companies, have higher compliance with the 2 gender diversity targets, but significantly lower compliance with the ethnic diversity target.

- During the year to March 2024, 47% of director appointments were of women, while 71% of resignations were by men. If this pattern continues the proportion of women on FTSE boards will keep increasing, as will compliance with the percent women target.

- 53% of FTSE non-executive directors (excluding Chairs and Senior Independent Directors) are now women. As these women non-execs gain tenure and experience, many are likely to progress to Senior Independent Director and Chair roles, bringing further increases of the compliance with the women leaders target.

Conclusions

FTSE board diversity and compliance with the related FCA rules are gradually increasing.

There are still large gender imbalances in the 3 most powerful and (usually) best paid board roles. Only 8% of FTSE CEOs are women, as are 19% of Chief Financial Officers and 18% of Chairs.

In most of the 556 cases of non-compliance with the board diversity rules, the company will be seeking to develop their boards to become compliant. This represents a substantial opportunity for executive search firms, especially if they are able to offer a diverse range of candidates.

____________________________________________________

Numerable is an innovative board intelligence platform with a database of LSE listed public companies, directors, appointments, and associated governance and diversity metrics. It continuously collects and harmonises published information from company registries, annual reports, websites and news releases. It has a range of powerful, interactive tools to browse, search, filter, sort and analyse. It is a cost-effective solution that is available on subscription.