FTSE Board Diversity – 70% Miss At Least One Target

The current FCA Listing Rules were updated in 2023 to include 3 board diversity targets for UK listed companies. 2 relate to gender diversity and 1 to ethnic diversity.

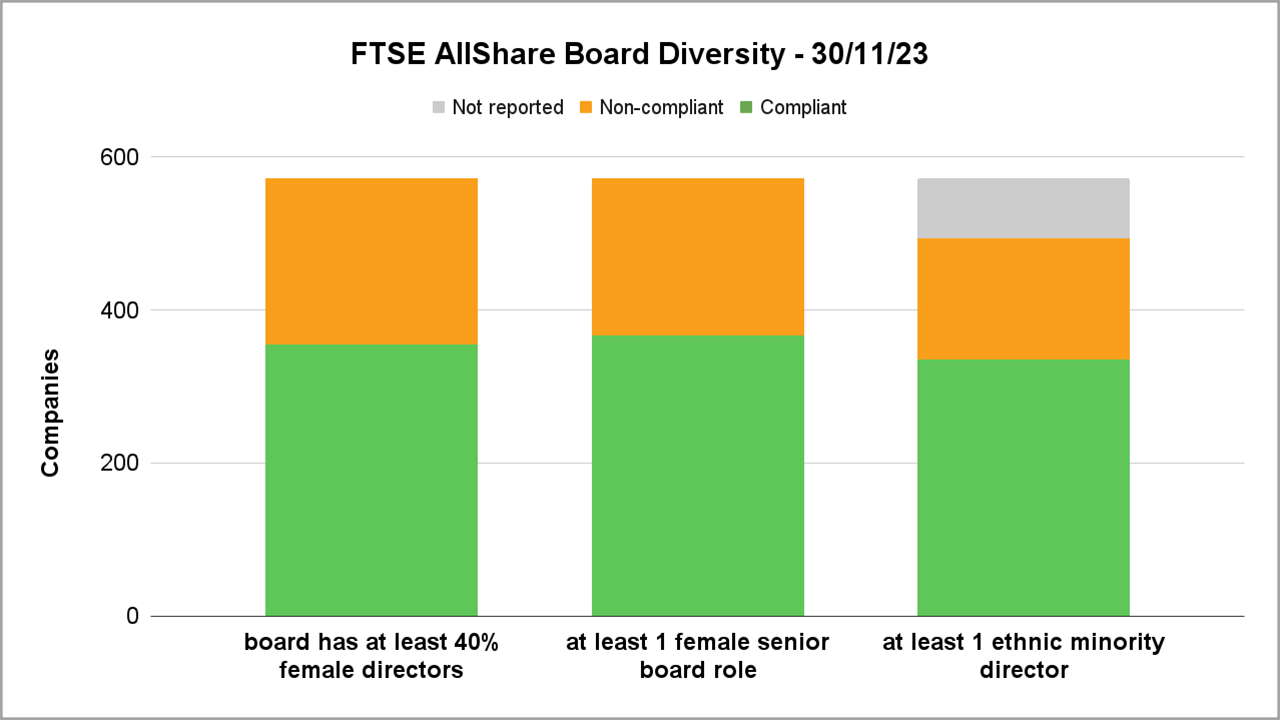

We’ve analysed Numerable‘s data to find how many of the 572 FTSE AllShare companies, on 30th November 2023, comply with each of these targets.

402 (70%) of the companies fail to comply with at least one of the 3 targets, and many are making succession plans to address this. This will significantly influence the recruiting of directors for several years to come.

The Targets

The FCA Handbook Rule LR9.8.6R(9) says that listed companies must disclose, in their Annual Report, whether they have met each of the targets – and if they have not done so, what are the reasons. This is usually termed “comply or explain”.

1. Proportion of female directors

“at least 40% of the individuals on its board of directors are women”

Compliant companies: 355 – non-compliant: 217

The 40% target is an increase on the previous target of 33%. Overall, 40.7% of FTSE directors are now women. But the Listing Rule target is that each company board should have at least 40% women, and 217 still do not. 5 companies have no women on their board.

2. Female Senior Board Roles

“at least one of the following senior positions on its board of directors is held by a woman: the chair; the chief executive; the senior independent director; or the chief financial officer”

Compliant companies: 367 – non-compliant: 205

This is a new listing rule target in 2023, aimed at driving up the currently low proportion (24%) of women holding these influential board roles.

3. Ethnic minority

“at least one individual on its board of directors is from a minority ethnic background”

Compliant companies: 335 – non-compliant:159 – not reported: 78

This new target in the 2023 Listing Rules covers a greater range of listed companies than the Parker Review, which had focussed on FTSE 350 companies.

Missed Diversity Targets

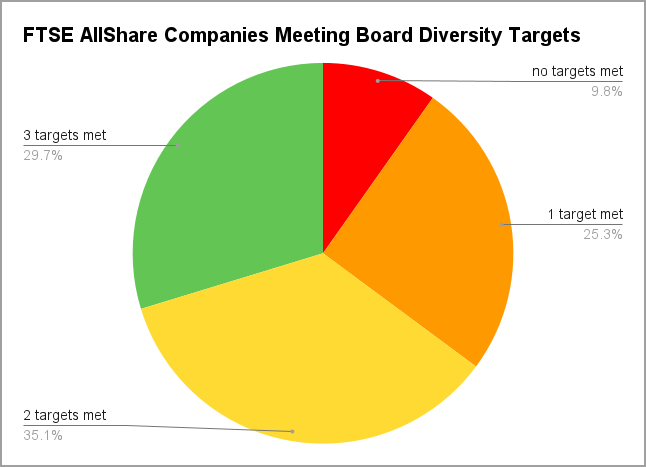

Just 170 (29.7%) FTSE AllShare companies have met all 3 board diversity targets.

56 (9.8%) of the companies have met none of the targets.

The rest have met one or two of them.

402 (70.3%) have missed one or more target.

Numerable identifies all of these companies, which are likely to be refreshing their boards.

Why Do Companies Struggle to Meet Diversity Targets?

Low starting points – Historically many FTSE boards had very low levels of diversity – they were full of ‘pale, stale males’, or old white men, to put it a bit more politely.

The Hampton-Alexander Report (now the FTSE Women Leaders Review), and the Parker Review, identified and tracked the low board diversity levels. They set objectives which led to the diversity targets now in the FCA Listing Rules. But the starting points for the 3 metrics against which the targets are set were all low.

Slow pace of change – FTSE boards only change slowly. The mean tenure for a FTSE AllShare director, since 2014, is 7.1 years. The mean board size is 7.5, so on average there is only around one new director each year appointed to each board.

Small boards – Many FTSE AllShare boards are small. 51 of them have 4 directors or fewer. That makes the rate of refreshing these boards even slower, and may lead to reluctance to prioritise diversity when recruiting new directors.

Investment companies – Most investment companies, such as trusts, have no executive directors. So they have fewer senior board roles as they are defined in the Listing Rule for the Female Senior Board Roles target. 184 FTSE companies have just two senior board roles – Chair and Senior Independent Director. A further 32 have only one, the Chair, as they do not have a Senior Independent Director due to their small board size. That makes it less likely that a woman will occupy one of the senior board roles, so these companies are more likely to miss the Female Senior Board Roles target.

Skills shortage? – The drive for more diverse boards has created a strong demand for women and ethnic minority directors with the appropriate skills and experience. Companies and their recruiting partners have had to work hard to find strong, diverse candidates, perhaps being more adventurous than before. This appears to have led to an influx of first-time FTSE directors, including some from overseas. Many companies have also recognised that they need to foster a more diverse pipeline of individuals, especially for executive roles.

Pressure to Change

As well as a natural desire to ‘do the right thing’ and to meet regulatory targets, companies and their boards are influenced by investment institutions and the proxy agencies that advise them.

When these institutions see that diversity targets are not being met, and are not satisfied with the plans to do so, they may vote against director re-appointments at AGMs. If investors believe that a company board has poor governance or diversity this can also affect their willingness to invest and impact share price.

This behaviour of institutions is in turn driven by the increasing desire of individual investors, especially younger ones, for their investments to be ethical. They want their savings to be invested in businesses that have good ESG performance – and board diversity is a significant part of the G (governance).

The Data

Numerable maintains data on the board roles and gender of every FTSE AllShare director. We can therefore determine at any time if a company’s board meets the female directors and female senior board roles targets. The information on compliance with these is current as at today’s date – 30th November 2023.

However companies do not (usually) disclose which of their board members are from an ethnic minority. This information is self-disclosed, on a voluntary basis, by each director to the company. The company then reports in their Annual Report if they have met the target for the board as at a reference date – usually the end of the accounting period. Our data on which companies comply with the target is taken from the disclosure in their most recent Annual Reports, and is therefore valid at a range of different reference dates in the past.

The ethnic diversity compliance of some of the companies may have changed since those dates if they have subsequently appointed any new directors from an ethnic minority, or if any have resigned. It is not currently possible to reliably track these.

Reporting against the ethnic minority target is only compulsory for Annual Reports covering accounting periods starting on 1 April 2022 or later. 78 or the 572 FTSE AllShare companies have not yet disclosed their board ethnic minority, but will be doing so within the next few months in their next Annual Reports.

____________________________________________________

Numerable is an innovative board intelligence platform with a database of LSE listed public companies, directors, appointments, and associated governance and diversity metrics. It continuously collects and harmonises published information from company registries, annual reports, websites and news releases. It has a range of powerful, interactive tools to browse, search, filter, sort and analyse.